Valuation and M&A Due Diligence

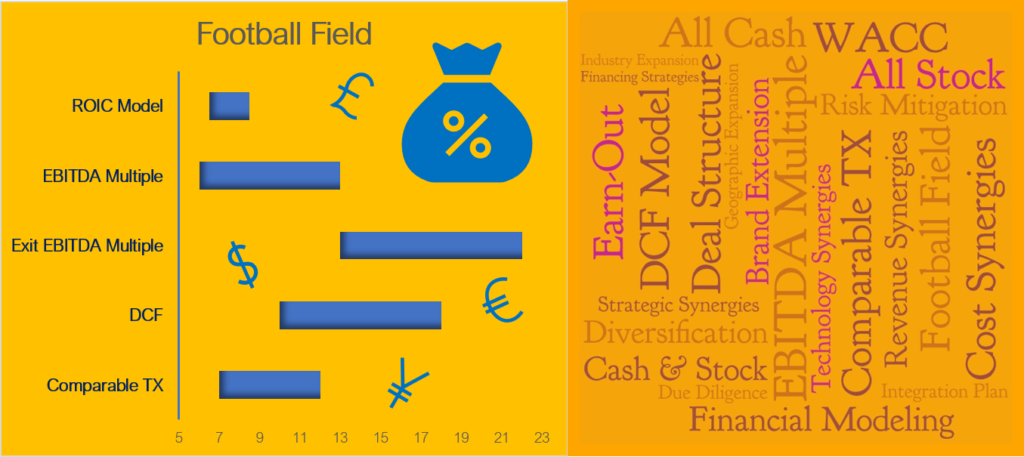

We offer full-range buying- or selling-side advisory services for any M&A transaction. Our analysts build you various financial models. However, we recommend utilizing our services for end-to-end due diligence process including market research, business plan, client presentations, negotiation, deal structuring, etc.

We differentiate us from the existing resources available in the market in the sense that we include multiple qualitative dimensions, interview with management and working team, fill in predefined questionnaires, and conduct detailed market research to help our clients gain deeper insights of the transaction. Our analysis on synergies and integration plan before initiating and during the dialogue not only guides realizable value from transaction but also strategizing comprehensive absorption. Even though you choose not to go with us, feel free to reach us for advice on improving your valuation. We strongly encourage the sellers to start working on the financials much before the actual transaction to gain the best deal possible.